We often think of Financial mess or turmoil as dramatic, newsworthy events.

Some live on in our memories…

Do you remember John Z. DeLorean? The charismatic automobile manufacturer of the DeLorean sports car experienced a financial mess disaster after the failure of his Dunmurry automobile plant, outside Belfast. The details of his blighted financial situation dominated the news cycle after an FBI sting busted him in a hotel room for a $24 million cocaine drug deal.

But financial train wrecks don’t just happen to high rollers in big finance.

This happens to people fresh out of college who suddenly find themselves responsible for more expenses than they can afford.

This happens to people who struggle with one low-paying job after another and whose financial situation keeps getting worse over time as the cost-of-living rises.

This happens to average people who “made it” but who experience a personal crisis that drains all their savings.

In short, this happens to almost everyone at some point. Sometimes, financial mess shows up in small ways but then gains momentum over time.

Table of Contents

Spiraling Into Debt

Once someone experiences a financial setback, they’re more likely to spiral into debt. It’s rare for most people to turn things around and restore financial stability. While credit cards can make it possible for them to spend more than they earn, it’s only a short-term fix. Over time, easy credit buries them deeper into debt.

3 Ways to Turn Things Around

Fortunately, it’s possible to turn your financial situation around if you’re up to the challenge. If you find yourself in debt, here are three ways to put it behind you:

1. Pay off Your Creditors

Although you may feel isolated and alone with your burden of debt, this is an illusion. Financial companies like Braidwood Capital can give you a consolidated loan to reduce your interest rates and pay off all your creditors.

A consolidated loan helps you systematically pay off all your other debts. You won’t have to juggle all your bills with their differing amounts and different due dates each month. Instead, you’ll make a single payment on your consolidated loan that will cover all your credit card payments, loans, or other debts.

2. Increase Your Earning Power

If you’re spending more than you’re earning because of the high cost of living, you need to flip this equation. When you earn more than you spend, you’ll be well on your way to peace of mind and financial stability.

While it makes perfect sense to increase your ability to earn more, you might have no idea how to even start.

If you’re working at a job, then find a reason for your company to give you a raise or a promotion. Still, if you’re working as hard as you can, but feel unappreciated, it may be time to consider a change.

You could get another job in your industry, switch to another career, or start your own business. If this seems too drastic, then another option is to start a side hustle.

3. Improve Your Financial Literacy

If you paid off your creditors and increased your income, there is still one more thing to do: improve your financial literacy. Schools rarely teach it and most people don’t learn it at home.

Managing your finances isn’t an inborn skill. It’s more realistic to think of it as a formal skill, like learning how to read, write, or calculate.

If you’re not good at handling money, then you need to educate yourself. Learn how to budget your money. Understand why it’s important to pay your bills on time. Figure out how to allocate a percentage of your earnings to your savings account.

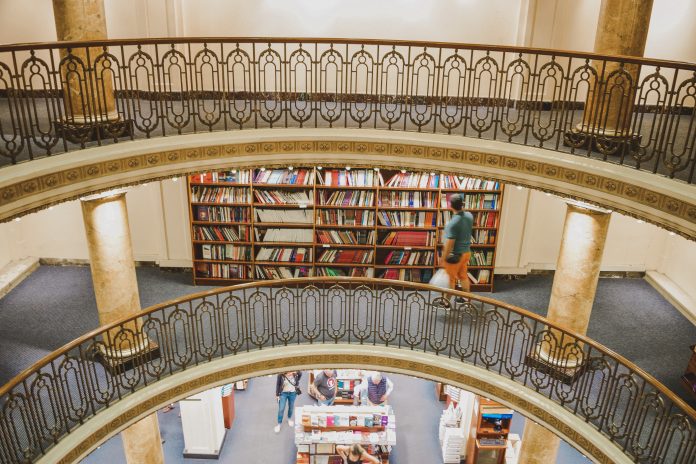

Find an online resource on how to manage your money or buy a book on personal finance.

Overcome Personal Finance Challenges

If you have more bills to pay then money to pay them, try these three ideas to end the struggle. First, pay off your creditors with consolidated financing. Next, increase your earning power. Finally, educate yourself about personal finance. With will and grit, you can overcome the challenges you face and be financially stable.