If you’re struggling with bad credit and need a loan to cover unexpected expenses or consolidate debt, stick around because this post is for you.

While having bad credit can make it difficult to get approved for a loan, it’s not a dead end – it’s just a stumbling block. The good news is, the internet offers plenty of options for people with less-than-perfect credit. You can access loans online through different platforms. But the issue is, with numerous lenders out there, accessing credibility can be quite an uphill task.

Not to worry, in this blog post, we’ll go over the useful methods to help you get online loans for bad credit. Whether you’re looking to secure a loan with collateral or improve your credit score, we’ve got you covered.

So, if you’re ready to take control of your finances and get the loan you need, keep reading!

Table of Contents

Getting Online Loans

As we’ve already established, learning how to get online loans for bad credit can be a lifesaver for those in dire need of cash. Unfortunately, finding a reputable lender is tricky. Even if you wade through the numerous scammers that take advantage of people struggling with their finances, you still have to be cautious when applying for an online loan.

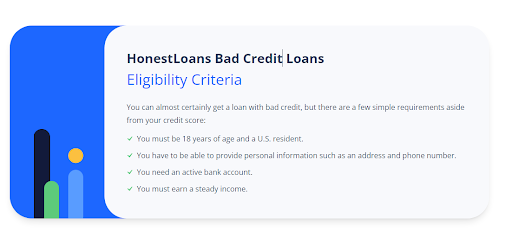

There are loan platforms for bad credit with outrageous interest rates and insecure payment procedures. However, platforms like Honest Loans can get you that security and flexibility you need. You can find more details about Honest Loans online. Now that we’ve gone through some of the things to expect, let’s look at the useful methods to get online loans for bad credit.

Good Methods to Find Online Loans for Bad Credit

There are several useful methods to help you get online loans for bad credit, and here are some of them.

-

Study and fact-check multiple online lenders

After coming to terms with your credit score and understanding your financial situation, finding the best suitable lender is the first step to getting a good online loan.

Avoid the common laziness of settling for the first loan offer you receive. Always be patient enough to research other lenders that may offer competitive interest rates and favourable repayment terms.

The best way to cement your choice will be by comparing loan offers from different lenders to see which one is the best fit for your financial needs. Honest Loans is a great place to start because they help you find lenders who offer accommodating terms.

-

Know your exact credit score beforehand

Before you apply for any loan it is common practice to check and know your credit score. Even if you already suspect that you have bad credit, it is still crucial to know your credit score before you apply for an online loan.

Your credit score will give you a better idea of the type of loans for bad credit you may be eligible for. It also facilitates the decision of recognizing which lenders are more likely to approve your loan requests.

Not to worry, credit scores are free and easy to ascertain. You can check your credit score for free through websites such as Credit Karma or AnnualCreditReport.com.

-

Get a co-signer

Although having bad credit really puts you down the pecking order in getting some of the best loan deals, you can salvage the situation by using a credible co-signer. Co-signers help share the financial burden in terms of the risks involved in acquiring a loan.

If you have a friend or family member with good credit, you can ask their permission and seek help to co-sign your loan. A co-signer increases your chances of getting approved for a loan and also potentially offers better interest rates from various lenders.

However, it is essential to remember that the co-signer is equally responsible for the consequences of a defaulted loan. So if you’re getting a co-signer or approached to be one, make sure the loan and its repayment terms are fair and attainable.

-

Secure the loan with a substantial collateral

Another way to shed a positive light on your poor credit score is to add collateral to your loan request. If you own valuable assets such as vehicles, houses, or art, you may use them as collateral to secure a decent loan even with bad credit.

This naturally increases your chances of getting approved and may help you command a lower interest rate. However, it is crucial to remember that if you default on the loan, the lender can seize all your collateral without consent.

-

Try out payday loans

Payday loans are a type of short-term loan that can be a good option for individuals with bad credit. They are structured to provide quick access to cash, usually within 24 hours of approval, and are typically easy to get approved. This is simply because unlike other loans, they do not necessarily require a credit check or collateral.

However, payday loans can come with some drawbacks, including high-interest rates and fees. The annual percentage rate (APR) on payday loans can be much higher than on regular loans. In addition, many payday loans require repayment in full, along with any interest and fees, within a short period, typically around two weeks.

Hence, you need to take time to always consider these types of loans before accepting any of their conditions. Ensure you fully understand the interest rate, fees, and repayment terms.

Additionally, be cautious of payday loan scams and only use them as a last resort. It’s usually a good idea to explore other options, such as a loan from a friend or family member, before taking out a payday loan.

-

Improve your credit score

If all else fails and you have time before you need to take out a loan, consider improving your credit score. This can help you get better loan terms and may increase your chances of getting approved. You can improve your credit score by paying your bills on time, keeping your credit card balances low, and avoiding applying for new credit too often.

Conclusion

By following these methods, you can find an online loan that fits your financial needs and helps improve your credit. Remember to be cautious and do your research before applying for an online loan.