Online loans are an effective go-to solution for anyone who is looking to quickly secure funding but is unable to get approval from traditional lending institutions.

Whether it is to deal with a medical emergency, an unexpected car repair, or even sudden travel costs, the rise of online lending companies has made it far easier than ever to secure funding when you need it most. In fact, most of these companies are open to approving your loan request, even if you have a history of bad credit.

In this respect, you can obtain bad credit loans from UKBadCreditLoans, which happens to be one of the most reputable companies in the current market. This review should help you identify if UKBadCreditLoans is really in the best position to meet your personal finance needs.

Let’s get started!

Table of Contents

What Does UKBadCreditLoans Do?

UKBadCreditLoans is an online credit broker that instantly matches borrowers with direct lenders based on their financial situation and specific loan requirements. The service is completely free-to-use, and it is carried out via a safe and secure platform that offers users a simple and straightforward loan application process.

According to Emilia Flores, the co-founder of UKBadCreditLoans, “Our platform is designed to streamline the online lending process for borrowers of all credit types. So, it doesn’t matter how low your credit score may be, as we are confident that we can connect you to a suitable lender within minutes.”

In terms of loan amounts, borrowers can typically hope to access funding as high as £5,000 with APRs that can vary up to 49.7% and repayment periods that often range between 1 and 36 months. On top of that, all approved loans are usually processed as soon as the next business day.

Who is UKBadCreditLoans Best For?

UKBadCreditLoans is primarily designed for borrowers that are in urgent need of funding and are looking to circumvent the tedious waiting process that often comes with traditional loans. Alternatively, the service can also be extremely useful for borrowers that have been unable to access loans from banks or credit unions because of a bad credit rating.

Also, since their lenders do not impose any restrictions on how you can use the funds that you borrow, this means that you can feel free to spend the money on whatever expense you need it for. This includes debt consolidation, home improvement, utility bills, etc.

Furthermore, UKBadCreditLoans has a network that is comprised of dozens of online lenders, which means that you also have access to a wide variety of loan products to choose from. Some of these include bad credit loans, payday loans, same-day loans, quick loans, etc.

How Can You Borrow A Loan via UKBadCreditLoans?

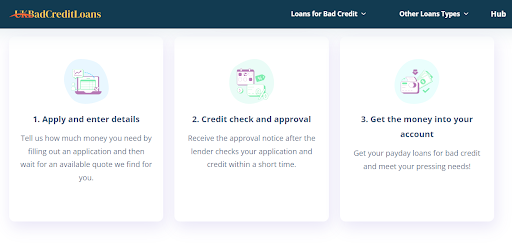

The good news about borrowing a loan from this platform is that qualifying for and receiving funding is a simple process that only takes a few steps to complete.

The first step involves filling out the online loan request form with your personal and financial details, e.g., name, address, bank account information, credit score, requested loan amount, etc. Once you submit the form, UKBadCreditLoans will instantly pass on your information to their network of lenders for review.

If approved, the next step is to review the various loan offers from various lenders, each with its own set of rates and terms to consider. You will be able to compare them until you find the one that best fits your current budget and requirements.

Once they approve your loan request, you can expect to receive the funds in your checking account within one business day. Once you receive the money, some lenders may opt to take their monthly payments from your checking account automatically on the agreed-upon due date.

In the rare case that UKBadCreditLoans is unable to help you secure a loan offer, the platform will redirect you to some other alternative credit services that you can use to get the funding you need.

What are the Highlights of UKBadCreditLoans?

There are a number of highlights that differentiate UKBadCreditLoans from most other lending services out there. Some of the main aspects to consider include;

#1. Secure Lending Platform

UKBadCreditLoans values user privacy by ensuring that its site is protected by advanced encryption software, which ensures that any information you share remains extremely safe and secure. On top of that, they have a strict privacy policy in place that guarantees your information will not be shared with any unauthorized third parties.

#2. 100% Free Loan Service

UKBadCreditLoans is not a direct lender. As a result, it does not charge borrowers any fees to use its online platform to connect with a potential lender. There is also no need for you to sign up for an account or pay for any type of membership, which means that you can feel free to check what loan offers are available to you at any time.

#3. Fast Loan Application Process

UKBadCreditLoans offers users access to a very simple and straightforward lending process that comes with minimum eligibility requirements and only takes a few minutes to complete. Once you are done submitting your application, you can usually expect to receive a loan offer within minutes. Also, since you can compare multiple loan offers instantly, this saves you a lot of time and effort compared to searching for lenders yourself.

#4. FCA-Compliant Lending Network

UKBadCreditLoans has an extremely wide network of lenders, which makes it easy to access multiple loan products as well as secure competitive interest rates and terms. However, the biggest benefit of this network is that their lenders are all FCA-compliant, which means that they are all licensed and heavily regulated by the government. As a result, there is no risk of finding yourself matched with a loan provider that uses predatory or unsavory lending practices.

Our Final Take: Should You Use UKBadCreditLoans Today?

There are many things that we like about UKBadCreditLoans. The platform is easy to use; they don’t charge any fees, and they can connect you to dozens of lenders almost instantly.

On top of that, they take data security very seriously, and they make sure to only partner with lenders that are legitimate and regulated. Plus, they are open to accepting borrowers of all credit types, which means that it is accessible to a wide range of consumers.

The only thing you have to be wary of is the fact that the loans offered tend to come with higher interest rates and shorter repayment periods compared to traditional loans. On top of that, failure to repay online loans on time can result in extremely high repayment fees.

As such, it is essential that you always review the loan offers you are provided on this platform very carefully, as you do not want to accept a loan that you cannot afford to repay. You should also avoid taking out these loans to pay for non-urgent or personal expenses like vacations or luxury purchases to avoid falling into bad debt unnecessarily.

In short, as long as you borrow responsibly, then you should have zero reasons not to utilize UKBadCreditLoans’ lending service to solve whatever financial challenges you may be facing.