Do you want to unlock the potential of stock trading? Then you need more than just a basic understanding of the market. In today’s environment, information spreads at lightning speed. Therefore, traders need effective tools to identify opportunities. These are opportunities that need to fit their strategy. It is where stock scanners come to the rescue.

Our article will immerse you in the world of stock scanning techniques. We offer traders a comprehensive guide. It will help you navigate the intricacies of scanners for stock trading. Whether you are a seasoned investor or a novice learning the stock market, utilizing the power of stock scanners can give you a competitive advantage.

In this article, we have described five proven methods. They will allow traders to filter stocks based on certain criteria. You will be able to identify trends and ultimately make an informed decision. Scan stocks artificially. Increase your potential for success in the ever-changing financial market.

Table of Contents

What is a Stock Scanner?

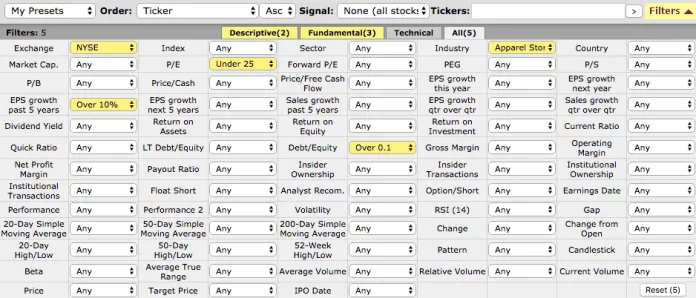

A stock scanner is a sophisticated tool. Traders and investors use this tool to analyze a huge number of stocks quickly. Like an aid, you can filter and identify stocks that meet certain criteria. Essentially, it is a software application. It automates the process of searching and analyzing stocks based on various parameters such as:

- Price

- Volume

- Technical indicators

- Fundamental indicators

- etc.

A stock trading scanner allows traders to identify prospective trading opportunities quickly. When compared to manual stock analysis, it saves time and effort.

Traders can set customizable filters and parameters. It can fine-tune the search according to their trading strategies. These scanners can identify patterns, trends, and anomalies in real-time. It helps the trader to make informed decisions.

Stock scanners are indispensable tools for navigating the complex and rapidly changing world of financial markets. It provides traders with a competitive advantage in identifying favorable opportunities.

Types of Stock Scanners

In the realm of stock trading, the ability to identify opportunities is paramount. It is where different types of stock scanners play an important role. They offer a variety of approaches to finding potential investments. Each type of stock scanner focuses on certain stock responses. It caters to different trading styles and preferences.

Below we will look at the four main categories of stock scanners. Many people wonder how to use stock scanners of different types. It is where we will give you the answer. Understanding these types of scanners gives traders a versatile set of tools. It will allow you to navigate the complexities of the stock market.

#1 Fundamental Stock Scanners

Fundamental stock scanners scrutinize a company’s key financials, including:

- Profit

- Revenue

- Debt

- And other key metrics

This scanner can help evaluate a company’s financial health and performance. It is how traders can identify stocks that fit their long-term investment goals. Fundamental scanners provide insight into the intrinsic value of a stock. They help traders make informed decisions. They are based on the growth potential and stability of the company.

#2 Technical Stock Scanners

Technical stock scanners focus on the following:

- Price charts

- Technical indicators

- Models to identify potential trends and reversals

These stock scanners help traders identify entry and exit points. They help gauge market sentiment and predict potential price movements. It analyzes historical price data and applies technical analysis. In this way, traders can detect patterns such as:

- Moving averages crossover

- MACD divergence

- etc.

It enhances their ability to time their trades effectively.

#3 Post-Market Stock Scanners

Post-market stock scanners operate after hours. They would if the market is looking for stocks that exhibit significant price movement after the close of trading. Traders can identify opportunities that arise from overnight news releases. These can be earnings reports and other market-influencing events. All events occur outside of standard trading sessions. Post-market scanners give a head start on the next trading day. They allow traders to adapt their strategies based on post-market events.

#4 Intraday Stock Scanners

Intraday stock scanners focus on real-time data. They help traders identify short-term trading opportunities. These scanners for stock trading track price and volume fluctuations. They would identify stocks with sudden bursts of activity. They can be stocks with unusual volume or out-of-chart patterns. Intraday scanners are invaluable for day traders and short-term traders. They take advantage of intraday volatility and capitalize on rapid price movements.

How to Use Stock Scanners

Many wonder how to use stock scanners. These are tools that traders and investors use. They use them to identify potential trading opportunities in the stock market. These scanners help to filter and sort a large number of stocks. You can do this by certain criteria or parameter points. We have prepared for you five effective methods for using these scanners. With our help, you can take your stock knowledge to the next level. So, get ready to learn our secrets:

Identifying Technical Patterns

You can use stock scanners to identify various technical patterns. These can be situations such as:

- Moving average crossovers

- Breakouts

- Trend reversals

- Chart patterns like triangles, flags, and heads and shoulders.

Set up a scanner for stock trading to filter stocks. They must meet certain technical conditions. For example, stocks that just crossed the 50-day moving average. Or a stock that is forming a bullish flag pattern.

Volume and Liquidity Analysis

Volume is a key indicator of a stock’s liquidity and market interest. You can use the scanner to find stocks with unusually high trading volumes. For example, trading volume compared to their average volume. It could indicate a potential news event, earnings announcement, or other catalyst. Something that could be the cause of the increased activity.

Sector or Industry Focus

Are you interested in trading or investing in specific sectors or industries? Then stock scanners can help you narrow down your options. You can scan stocks in a specific sector. It will meet the criteria you need. It will allow you to focus on sectors that you are more familiar with.

Stock Scanners for Pure Power Picks Trading Room

Stock scanners are the backbone of Pure Power Picks’ dynamic trading room environment. Our scanners serve as a critical tool for identifying promising trading opportunities. Using advanced technology, our scanners analyze market data in real-time. They analyze technical indicators and volume patterns. So you can identify stocks with maximum profit potential.

The scanners allow floor traders to detect and capitalize on market movements quickly. From breakout candidates to momentum players. By utilizing stock scanners, Pure Power Picks trading room members gain a competitive advantage in navigating the intricacies of the stock market.