If you are employed in a paid job, you must have seen that your paycheck consists of two different numbers. They are ‘gross pay’ and ‘net pay.’ Whether you receive a yearly salary or hourly wages, you must be familiar with these two terms. But you still don’t have a clear idea about them? Well, then, no worries. In this article, we will give you a clear overview of what is net pay, how to calculate them, and all. Moreover, stay with us to get information about gross pay, basic salary, and differences. So without further ado, let’s dive into it.

Table of Contents

What is net pay?

In short, the employees usually pay Net pay by making all the necessary deductions from the total gross pay. In broad terms, let’s clear out about the mentioned necessary deduction here. Deductions, for instance, Health care, Medicare, Social Security Taxes, Federal Income Taxes, the contribution of retirements, assistance to other expenditures, etc. As a result, these deductions have to be subtracted from the gross pay in total.

The employee receives the rest of the payment to pay for their usual living costs, food, housing, etc.

Distinguish Between Net Gross & Net Pay

In terms of payroll, employees can receive wages by two methods. One is net gross, and another one is net pay.

Net pay is the amount of money that an employee receives after all the required deductions have been made. In another way, it is the money that they get as payroll.

On the other hand, when an employee receives payments before deducting any tax fee and stuff that is called gross pay. For instance, when you are talking about paying $30,000 a year, you mean paying $30,000 as gross pay.

What is Balance of Net Pay

Suppose you have an account that you use for direct deposit. Now, it means if you get the paycheck, it’ll be directly deposited into that particular account.

On the other hand, if you set up multiple accounts, your paycheck will be deposited into the last account. This means on payday. Your check will be directly issued for the last account. It is the balance of net pay.

Everything about deductions from Gross Pay

In order to conduct any agreement paper for a job offer, employees need to fill up the W-4 form. In this form, employees declare and agree on the amount of the deductions. Then this deduction is subtracted from the gross pay total of the employee. This is how you can calculate gross pay.

Examples of Deductions

There are a bunch of varieties of deductions in gross pay example. For instance, one deduction is for a single employee, whereas a married employee with four kids can take up to four deductions. You have to pay the taxes needed without paying extra. But in this case, the government can use the employee’s money if he overpays the taxes. But an employee can get a refund of the extra payment from the IRS if he fills out an income tax return.

P.S Note that net pay is not one of the voluntary deductions. For example, social security, Medicare, taxes are subtracted from gross payment. Moreover, charitable contributions, such as life insurance and disability insurance, also need to be deducted.

If we have a look at the law and regulations related to deduction, then keep in mind that court-ordered garnishment is another factor that is subtracted as well. We all know that US tax laws are a bit complicated. As a result, while venturing down the path of immediate hiring, you may want to include the State Department of Labor. An employment law attorney is a part of this. Your payroll taxes may also involve your business accounting firm as well.

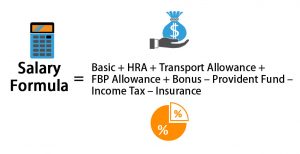

The formula of Net Pay

In terms of easy calculation, we can fall the net pay under a formula. Here, you can use it as a net pay calculator.

Net Pay = Gross Pay – Deductions & Taxes

How to figure out the Net Pay of employee

In broader terms, the deductions of the net pay include some necessary factors, such as the employee’s savings fund and retirement fund. In this case, the part of employees’ expenses is paid to the employee directly. So we can understand one thing: the money an employee takes home is considered net pay. You might be wondering what is net pay on payslip. Well, it is the payment statement that an employee receives from the employer.

For a net pay example, if we switch to a mathematical calculation, we will understand it easily. Suppose if an employee is receiving $100,000 as gross pay. From this amount, he takes home around $60,000 each year. We can see that he’s having deductions of around $40,000. Here deductions like taxes, retirement contribution, and other factors are included. So, now you know how to calculate net salary from this.

How to figure out the Gross Pay of the employee

In order to calculate the gross pay, you will need your regular pay statements. Moreover, your official employment contract also includes all features of your gross pay. For instance, if an employee receives $10,000 per month as gross pay, his yearly gross pay can be done with a simple calculation. It is $10,000×12 = $120,000. So, it is the gross income of the employee.

Well, there is another situation that you need to consider. The bonus factor is something that you need to understand. For instance, if an employee is getting $120,000 per year while taking $10,000 bonuses a year, then the flat rate of tax would be 22%. In this case, the total gross pay will be $130,000 per year where the employee might have to pay a higher or lower tax rate. The tax rate depends on how the employee files the taxes.

Gross income for Wage Employee vs. Salaried Employee

There are a bunch of differences between gross income for both wage employees and salaried employees. Salaried employees receive their gross income depending on their pay statements, official contract agreement, and other factors. So, an employee with $8,000 per month will have $8,000×12= $96,000 as total the hours are gross income.

Whereas, if an employee is working based on the hourly wage, the hours are not confirmed as an official contract agreement or payment statement. So, an employee with $30 per hour with 40 hours per week will have a gross income of $1200, and monthly income will be around $4,800. So his total gross pay will be about $4,800×12= $576,000 per year.

FAQs

Q1: How is Tax related to Met Pay?

Answer: When all the deductions are completed, the remaining gross pay is considered net pay. Most of the paychecks include withholdings, year-to-date earnings, etc. So-net pay is most likely to be paid after deducting the tax. But there are some different facts also had.

Q2: What does net Take-Home salary mean?

Answer: The take-home salary is mostly named as net salary. It means when an employee gets paid from his gross pay and then receives the take-home pay after deducting tax and other vital dedications. It is also referred to as an in-hand figure that is paid to the employees.

Q3: Difference between net salary and basic salary?

Answer: There are a few differences between net salary and basic salary. Well, an employee receives the net salary after deducting all the deductions from gross salary. On the other hand, a basic salary is a fixed amount that is received by the employee.

Q5: What do you mean by basic salary?

Answer: When an employee does not have to add extra payments to the primary salary that is called the basic salary. After calculation of the basic salary, facilities or fees are added to the main salary of the employee.

Final Thoughts

Well, now we are confident that you have received a crystal clear overview of what is net pay and how to calculate the payments and all. Moreover, the article has made extensive discussion on gross pay and basic salary as well. Hopefully, you have found this article informative. If you do, give it a thumbs-up and comment below if you have any queries related to it. Stay safe!