Purchasing travel insurance makes sense if you want to safeguard the money you’ve budgeted for your trip. After paying for your airline, lodging, food, and activities, it’s understandable if you’re afraid to add another additional expenditure to your vacation budget.

It’s not time to wonder how to get a loan with bad credit history, as you always have one more option. Travel insurance is still a wise purchase if you can’t afford to lose that cash in the event of an unforeseen circumstance.

According to Squaremouth, a website that compares travel insurance, the typical trip with insurance costs roughly $5,453. The average cost of travel insurance was $252. Your dream trip may cost considerably more than that, or you may be taking a long weekend getaway that costs much less. Travel insurance typically costs 5% to 6% of the total cost of your vacation.

Table of Contents

What Is Covered by Travel Insurance?

Many travel-related hazards are covered by travel insurance, including flight delays, lost luggage, and unexpected medical expenses. Your coverage’s monetary amount is determined by the insurance you purchased as well as the location, date, and time of purchase.

The majority of travel insurance providers provide a number of different policies, each with varying levels of coverage and pricing to match. You may get insurance for a single trip, many excursions, or a whole year. You may choose a policy that only protects you or one that includes your complete family.

How Does Travel Insurance Work?

Travel insurance pays for unanticipated incidents and catastrophes that either prevent you from leaving on vacation or impact you while you’re gone.

- Travel insurance may or may not provide coverage for the following

- Medical costs in the event that you become sick or have an accident while you’re gone.

- Cancellation of your travel due to circumstances beyond your control.

- Unclaimed or stolen luggage

What Does Travel Insurance Cost?

The terms and price of a plan differ greatly, and travel insurance is not a one-size-fits-all product. It is a good idea to make an effort to comprehend the insurance plan’s pricing parameters before committing to a purchase.

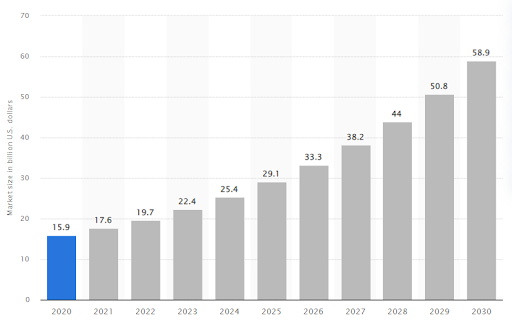

According to Next Move Strategic Consulting, the travel insurance industry, which was approximately 16 billion dollars in size in 2020, will grow to be around 59 billion dollars in size by 2030.

Travel insurance coverage should typically cost between 4% and 10% of the total, non-refundable trip expenditures. For instance, if you purchase a trip for $5,000, the available travel insurance coverage would probably cost between $250 and $500, depending on several factors.

Aside from the cost of the trip, the insurance company also considers the following variables when determining the price of your plan:

- The number of travelers;

- Age;

- The type of coverage;

- Distance traveled;

- Point of departure;

- Location.

When You’re Not Using It

Think of your trip as an investment. Would you be willing to let that money go? In general, it is generally not worth it to invest in travel insurance if you are just spending a little amount on your vacation.

For Travel to the United States

Are you going to Florida? Taking a road vacation across the American Southwest? Probably no need for additional insurance. Domestic travel costs are often lower, and most individuals only make last-minute plans a few weeks out. According to ValuePenguin, an average domestic vacation takes four days and costs $576 per person.

For Flights

When a ticket costs hundreds or thousands of dollars, the temptation to get trip cancellation insurance might be great. However, if you are aware of your rights as a passenger, the basic plans typically aren’t worth the cost to cover only your travel.

For instance, in the event that your trip is canceled, you are often entitled to the next seat on the subsequent aircraft that departs for your destination. If you have insurance, it won’t really speed up the process of having you rescheduled.

Just to Be Flexible

To leave your choices open, you shouldn’t use trip insurance. They mistakenly believe it to be some sort of cancellation policy, which is something that some individuals do. Especially when it comes to your accommodation, that might be a money-wasting move. Choose a hotel reservation that includes free cancellation up until your stay rather than getting full comprehensive coverage.

When Should You Buy Travel Insurance

Travelers returning to the U.S. will no longer need to test negative for COVID in order to rejoin the nation as of June 12, 2022, allaying concerns that they may end up staying in a foreign country longer than expected.

However, the Centers for Disease Control and Prevention recommends against traveling if you have symptoms similar to COVID. Other instances, though, make purchasing travel insurance worthwhile. As the globe recovers from COVID-19, travel insurance revenues are expected to be nearly four times more in 2030 than in 2020.

Source: https://www.statista.com/statistics/1289810/global-travel-insurance-market-size/

Travel insurance plans with basic trip cancellation coverage frequently include those reasons for canceling if you are worried about bad weather delaying your vacation, an unforeseen health crisis involving you or a family member, a terrorist attack, or even about losing your job.

Consider a cancel for any reason policy if you’re going to where there have previously been more onerous COVID-related travel restrictions or other COVID-related worries. Check the visa requirements for any nations you often visit because some still demand travel insurance.

Furthermore, there is no assurance that the United States will continue to exclude air travelers returning from overseas from COVID testing. The testing requirement will be re-evaluated on September 10, 90 days after it was suspended.

Conclusion

Travel insurance is probably a smart option if you’ve paid a sizable sum for a non-refundable holiday. International tourists who require insurance for illness or injury should also consider purchasing a policy. You’ll be relieved that you’re protected if problems do develop.