You can’t work forever, and when you get old, then you have to rely on your retirement income. According to business dictionary, retirement income means “The amount of money an individual earns after retiring based on retirement savings assets, Social Security allowances, pensions, stocks, mutual funds, savings accounts, CDs, home equity funds, annuities, insurance, rental income, royalties, or inheritances.”.

Every person must have to make the best retirement plan. Through an efficient strategy, you would be able to enjoy some peace of mind because you know that you have a proper income source even after you get retired. Here are four steps which let you make an efficient retirement income plan. According to Forbes, a person can’t rely on Retirement Plan A only; he must make a Plan B and C as well.

Step No.1 Start with a Template

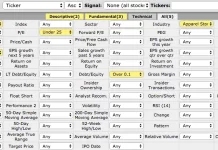

You can find some online retirement income plan templates, get them, and start working on your plan. In case you don’t get any suitable model then make the most from excel /spreadsheet. Open a new sheet. Give it a title as “Retirement income plan.” Assign one row for one calendar year. However, before this template, you have to ask yourself when you want to retire i.e., at what age. .Now if you’re going to retire at 65yrs age, then your column will begin from 65 and continue to the years based on life expectancy like 70-80 years. Give column headings to what you are going to add into your plan.

Step No.2 What to must add in your Retirement income plan?

You need to make a list of fixed sources of retirement income such as your social security allowances, pension, earnings, one-time income sources and some other places from where you can earn.

- Add social security allowances, both yours and your spouse in a separate column. Start from the year when you will attain these benefits and continue to life expectancy year.

- Next thing is a pension which you are going to take at your retirement age. Add yearly pension amount into another column. When you are making a retirement income plan for you and your couple, then you should also add his or her pension amount in the column.

- Annuity income is an amount of fixed money which you will get when you have got an annuity which starts at a certain age and date. The annuity payment will begin after that date and continue to set a period.

- Many people start a part-time job after retirement. If you have the same plan, then you need to add your this job’s earning into the plan.

- If you have made some real-estate investment and you are getting some rental income from it, then it is another fixed income source to add into your plan.

- Many times you have one-time lump-sum money from the sale of a property, insurance money and something similar. Make a separate column, if you have such a source of unique income.

Step No.3 Do Expense Calculation

It’s time to make an estimate of your living expenses. If you want to cut your expenses in the future like moving to an area beside the city or somewhere where rental costs are limited, then you should also consider this point in mind. When you have a mortgage plan whose payments will be due during your retirement time, then make a separate column for it. If there is any other loan amount, whose payment is yearly due; make sure you also add them into your plan.

You must have to make a yearly tax payment, which is dependent on your total income and deductions. The tax rate is an important consideration. In case you feel it confusing to deal with tax and another expense issue then you should read the book of David Macchia about Retirement income business opportunity. He is Founder and CEO of Wealth2k, Inc.

He has been working on a retirement income plan since 2004; therefore, this entrepreneur has enough knowledge and experience to guide a person regarding his retirement plans. The good thing is that he brings both academic and practical solutions in the book.

Step No.4 Start Calculation

Once you add all your income sources and income/tax information in the sheet, then the next thing to do is to start the calculation. The main idea here is to calculate the gap. If your expenses are more than your income, the difference will be negative. It shows that you have to find some other income sources and start working on your saving.

When income is more than expenses, the gap will be surplus. It means that you have enough income to enjoy your preferred lifestyle during your retirement.

5 Factors that might Affect your Retirement Plan

One thing that you need to understand at this step is that this plan is not perfect; it can get affected by many factors. I want to provide you quick details of those factors which can disturb the program balance one way or another.

- Inflation is the most critical factor. Therefore, you have to add 4 percent inflation into your plan, just to stay on the safe side.

- If you retire early than your plan age, then this whole plan would be disturbed.

- When you invest your saving, then its monthly return will also become a part of fixed income sources.

- In case you have some medical emergency, there will be uncertain expenses.

- When you expected a life span of 15 years, but it is more than 15, then your plan will be changed.

Wrap up

I have provided you a simple step by step guide to map out a good retirement income plan. I also suggest you consider some ways with which you make money through your savings. David Macchia’s book Lucky Retiree will bring some ideas on how you can start some profitable business that proves valuable in the long turn. Still, have some questions regarding retirement income plan? Feel free to ask.